The venture capital landscape in Africa is witnessing a surge in gender-lens investing, with a growing number of funds explicitly targeting female founders. Yet, despite this apparent progress, women-led startups continue to face significant hurdles in securing funding, raising questions about the effectiveness and reach of these initiatives.

The stark reality is laid bare by recent funding figures. In 2024, female founders in Africa raised a mere $48m, a precipitous drop from the previous year and the lowest amount recorded since data collection began in 2019, according to Africa: The Big Deal. This figure pales in comparison to the over $2bn secured by male founders in the same period. While gender-diverse teams fared slightly better, raising $121m, startups with solely female founders or all-female teams received a paltry $21m. This disparity echoes historical trends, with solo male or all-male founding teams consistently capturing the lion’s share of funding. In 2023, for example, they received 85% of the total, leaving just 2% for their female counterparts.

This funding gap persists despite the emergence of dedicated Africa-focused venture capital firms, many led by women, with a mandate to support female entrepreneurs. Firms like FirstCheck Africa and Aruwa Capital Management are making strides, but their average ticket sizes remain relatively small. Even larger funds with public commitments to gender-balanced investments appear to be falling short, with investments in male-founded ventures still significantly outweighing those in female-led businesses.

Janngo Capital, a pan-African venture capital firm led by Fatoumata Bâ, a prominent Senegalese entrepreneur, recently closed its second fund at €73m ($78m), exceeding its target. While the fund has emphasized its commitment to backing startups promoting gender equality and diversity, its recent investments have predominantly favoured male-founded ventures, particularly in Francophone Africa. Similarly, Alitheia IDF, a female-founded fund with $100m under management, has made substantial investments, including a $2.8m injection into South Africa’s ALMA Clinics, a female-run healthcare provider. However, its portfolio, like many others, still leans heavily towards male founders.

Ingressive Capital, another female-led Africa-focused firm, has also publicly committed to advancing gender equity and has made some progress, investing in female-run startups like Sixth, Splice, and Surge Africa last year alone. However, the overall picture indicates that much more needs to be done.

One argument often cited to explain the funding disparity is the perceived scarcity of female founders. While data from 2020 indicated that women held only 15% of co-founder and C-level positions in African startups, compared to 85% for men, this does not fully account for the funding gap. Similar disparities exist globally. A recent Carta Equity Report revealed that in the US, women represented 14% of solo startup founders in 2021 but received only 2% of VC funding. The situation is even more pronounced in Europe.

The lack of female representation within the VC industry itself is a contributing factor. According to the IFC, only 12% of senior general partners in sub-Saharan African private equity/venture capital firms are female, compared to an even lower 11% globally. This global figure is particularly relevant given the increasing involvement of international firms in African investments.

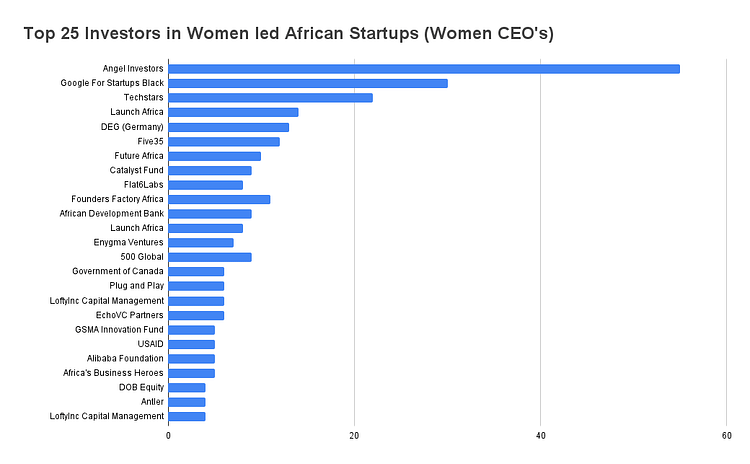

Launch Base Africa has observed a growing trend towards gender-lens investing, suggesting that increasing the number of women in senior VC and private equity roles is crucial. However, it also emphasizes the need for male investors to address their own biases.

Beyond investor bias, broader macroeconomic challenges and increased risk aversion among investors, particularly after recent investment setbacks, play a role. The struggles of some African female-led startups, such as the failure of all of Y Combinator-funded all-female teams and the internal issues that plagued startups such as Pivo, highlight the complex challenges faced by entrepreneurs, regardless of gender.

The Bottom Line

While the rise of gender-lens investing in Africa is a positive development, the persistent funding gap for female founders reveals a significant disconnect between intention and impact. Simply launching funds with a gender focus is not enough. Systemic changes are needed, including greater female representation within the VC industry, addressing unconscious biases among investors, and providing more tailored support to female entrepreneurs navigating the challenging African business environment. Without these changes, the promise of gender-lens investing will remain largely unfulfilled.