Among African angel investors, one goal stands out: equity exit to later-stage investors. A new report, backed by African Entrepreneurial Ecosystem Investors, Aspen Network of Development Entrepreneurs (ANDE), the Criterion Institute, and 2X Global, highlights that most African angel investors see this as their main objective. This desire mirrors the popular ‘10x exit’ strategy often pursued by investors in the Global North, although it’s less common in Africa.

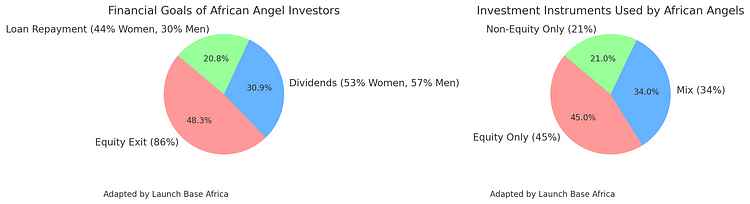

According to the report, 86% of both male and female investors favor this type of exit, showing a strong inclination to sell their equity to bigger investors as their startups grow. Although reaching this level of return is harder to achieve in Africa, the ambition remains.

Beyond equity exits, many angels are also interested in other financial gains. For example, 53% of women and 57% of men said receiving dividends is an appealing goal, meaning they expect the companies they invest in to become profitable. Additionally, 44% of women and 30% of men prefer getting their loans repaid with interest, which suggests they are using a combination of debt and equity to make their investments.

The report also looks at the benefits of co-investing. Co-investing allows multiple investors to share the risks, spread out their capital across different investments, and work together on due diligence and deal-making. It’s a strategy that has grown in popularity among African angels. Yemi Keri, Founder of Rising Tide Africa, emphasized the value of co-investing: “Naturally, co-investing makes things less risky. You look for alignment in investment philosophies, and you invest alongside with them. Interestingly, some women I know who solo invest are typically those who already started investing before they became members of angel groups.”

In a survey of 53 active investors, the report found that almost half (45%) of the respondents exclusively use equity instruments, such as traditional equity and simple agreements for future equity (SAFEs). Meanwhile, 34% use a mix of equity and non-equity instruments like debt or convertible debt, and only 21% rely solely on non-equity instruments, making this the least common approach.

The types of businesses angels fund in Africa are diverse. Some focus on fast-growing small companies where taking an equity stake may not make sense, so investors might opt for revenue-sharing models instead. However, 70% of the angels surveyed said they are most excited by businesses that are disruptive and scalable. For these types of investments, equity instruments like SAFEs can be very attractive because they let investors delay assigning a valuation to an early-stage startup. However, local regulations, such as in Kenya, may limit the use of SAFEs and other flexible instruments.

The report suggests that while African angel investors are eager to exit equity to later-stage investors, they are adapting to the unique realities of the continent’s startup ecosystem. By using a mix of debt and equity, and co-investing with others, African angels are finding ways to manage risks while still chasing high returns. This blend of strategies highlights the evolving and diverse nature of angel investing in Africa.