Karooooo, the Singapore-headquartered IoT SaaS provider founded by South African tech tycoon Zak Calisto, has established a strong reputation with its subscription-based revenue model, offering valuable lessons for African startups. This strategy has been particularly fruitful for its subsidiary, Cartrack, which saw a 15% year-on-year boost in subscription revenue for the three months ending May 31, 2024, hitting ZAR 959.6 million ($52 million). This surge played a crucial role in Karooooo Group’s overall 9% revenue growth for the same period, bringing in ZAR 1,081.8 million ($59 million). Notably, subscription revenue made up a hefty 89% of the group’s total income during this time.

Vertically Integrated Operations

A cornerstone of Karooooo’s success lies in its vertically integrated business model. Unlike many SaaS providers that focus solely on software development, Karooooo controls nearly every aspect of its operations, from controlling the hardware that utilizes its software to providing comprehensive support services. This approach grants the company greater control over its products and enables it to deliver a seamless customer experience. In the rapidly evolving IoT landscape, Karooooo’s vertical integration strategy allows for rapid innovation and responsiveness to market demands, setting it apart from competitors.

The 2021 acquisition of Cape Town-based logistics startup Picup Technologies for R70 million ($4.8 million) further solidified Karooooo’s vertical integration. CEO and Founder Zak Calisto highlighted the strategic alignment of this acquisition with the company’s vision of providing comprehensive mobility solutions for both current and future enterprise needs. By integrating Picup’s capabilities, Karooooo expanded its reach into the logistics sector, strengthening its position as a holistic provider of IoT-enabled solutions.

A Proprietary and Comprehensive Product Portfolio

Karooooo’s proprietary cloud platform empowers customers with real-time data analytics and business intelligence reports, maximizing the value derived from their data. This platform is continuously evolving, with regular updates and enhancements that ensure its relevance and indispensability for subscribers. The company’s commitment to innovation is reflected in its research and development investments, which saw a 20% increase, underscoring its dedication to maintaining a cutting-edge platform.

Beyond connected vehicles and equipment, Karooooo’s IoT solutions span fleet management, field worker management, video-based safety, risk mitigation, delivery management, and ESG compliance. This extensive product portfolio caters to a diverse range of enterprise customers, contributing to a robust 17% subscriber growth in the quarter ending May 31, 2024. Karooooo’s ability to address various pain points across different industries through its comprehensive offerings has been instrumental in its rapid growth.

Investment in Retaining and Reaching New Customers

Karooooo’s subscription growth is also heavily driven by its substantial investments in sales and marketing, research and development, and general administration. For instance, Cartrack’s sales and marketing expenses increased by 21% to ZAR 139.9 million ($7.6 million), highlighting the company’s commitment to customer acquisition and territorial expansion. Additionally, research and development expenses rose by 20%, emphasizing Karooooo’s dedication to enhancing its connected cloud platform and introducing innovative features to attract new customer groups.

Global Footprint and Diversification

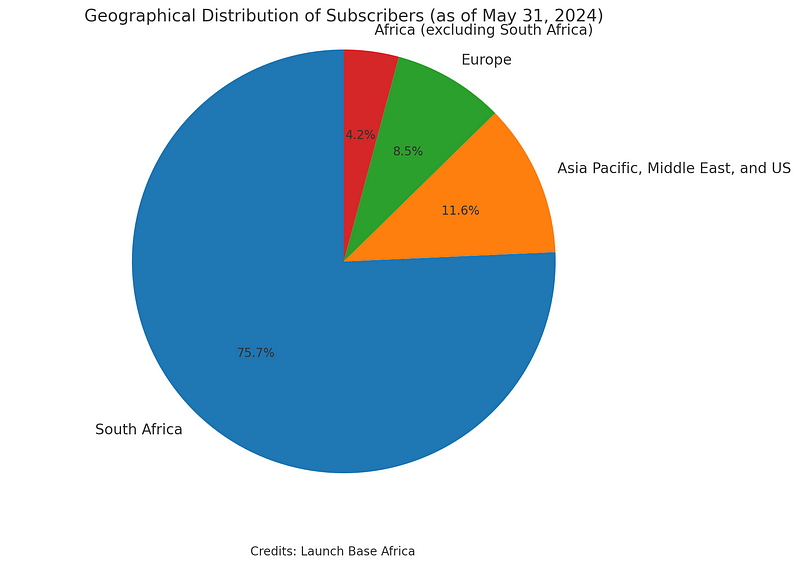

While based in Singapore, Karooooo’s influence is global. The company has seen significant subscriber growth in regions like Asia Pacific, the Middle East, the United States, and Europe. This global expansion not only diversifies Karooooo’s revenue streams but also mitigates risks associated with relying on a single market. For the three months ending May 31, 2024, the company reported a 23% increase in subscribers in the Asia Pacific, Middle East, and United States, and a 17% increase in Europe.

Geographical Distribution of Subscribers and Revenue

- South Africa: Subscribers increased by 16% to 1,549,951, with a corresponding 15% growth in subscription revenue.

- Asia Pacific, Middle East, and United States: Subscribers grew by 23% to 238,174, resulting in a 19% increase in subscription revenue (21% on a constant currency basis).

- Europe: Subscribers rose by 17% to 173,588, translating to a 19% increase in subscription revenue (15% on a constant currency basis).

- Africa (excluding South Africa): Subscribers increased by 14% to 85,729.

Competitive Pricing

Karooooo’s competitive pricing strategy makes its subscription services appealing to businesses of all sizes. The company offers flexible plans tailored to diverse customer needs, attracting a broad customer base ranging from small businesses to large enterprises. Karooooo’s Cartrack service, for instance, is priced at $30 per vehicle per month. The package includes nationwide installation, hardware, and requires no upfront costs or fixed contracts, providing significant value and convenience to its users.

A Snapshot of Karooooo’s Financial Performance

For the three months ending May 31, 2024, Karooooo’s overall revenue was ZAR 1,081.8 million ($59 million), marking a 9% increase from ZAR 996.8 million in the same period in 2023. Cartrack, a key subsidiary, saw its revenue climb by 15% to ZAR 981.1 million, with subscription revenue also rising by 15% to ZAR 959.6 million.

Karooooo Logistics, another subsidiary focused on delivery-as-a-service (DaaS), reported significant revenue growth of 63% to ZAR 100.8 million ($5.5 million). This segment’s growth, driven by third-party drivers and logistics companies, highlights the diversified nature of Karooooo’s operations. Picup Technologies, acquired in 2021, was rebranded as Karooooo Logistics.

The Bottom Line

Karooooo’s subscription model has proven to be a winning formula, offering valuable lessons for businesses seeking to thrive in the African market. However, the company acknowledges the challenges of rising operating costs and intensifying competition in the IoT market. Nevertheless, Karooooo’s journey demonstrates the effectiveness of a subscription-based model when coupled with vertical integration, strategic customer acquisition, and relentless innovation. As the company continues to invest in its future, it is well-positioned to remain a leader in the competitive IoT SaaS market.