Paris and Tunis-based agritech nextProtein has secured an €18m (approx. $20.7m) Series B funding round. The deal, co-led by Swen Capital’s Blue Ocean Fund and British International Investment (BII), the UK’s development finance institution, also includes €4m in debt financing.

The company plans to use the capital to build its second and largest production facility in Tunisia, aiming to scale its insect-based ingredients to compete with traditional commodities.

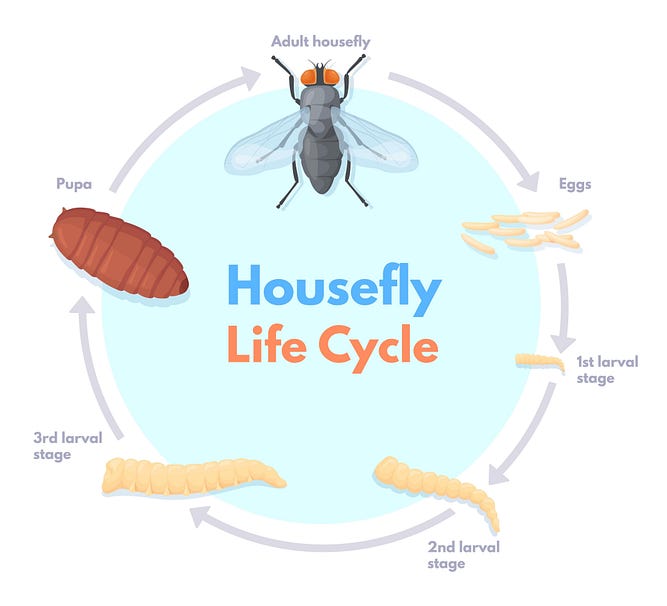

nextProtein tackles the growing demand for sustainable animal feed. It uses Black Soldier Fly (BSF) larvae to convert low-value agricultural and food byproducts into high-value protein powder (nextMeal), oil (nextOil), and fertiliser (nextGrow). These products are primarily sold to the aquaculture, livestock, and pet food industries as a replacement for resource-intensive feeds like fishmeal.

The company’s model hinges on cost-efficiency. “Our model focuses on CAPEX & OPEX efficiency and is designed to utilise highly variable low-value feedstocks,” said Mohamed Gastli, co-founder and CEO of nextProtein. He added that this approach addresses a “critical industrial bottleneck” and allows the company to “offer cost-efficient ingredients that can be mainstreamed across global supply chains.”

The new facility in Tunisia is at the heart of this scale-up plan, designed to produce 12,000 tons of insect-based ingredients annually, including 2,500 tons of protein powder.

Existing investors Mirova and RAISE Impact also participated in the equity round, with the debt package provided by Société Générale, CIC Paris Innovation, and La Banque des Start-ups by LCL.

A Sector Facing Scaling Hurdles

The significant funding round comes at a challenging time for the insect protein industry, which has seen high-profile setbacks.

Just last month, the South African competitor Inseco, which had raised one of the country’s largest-ever seed rounds ($5.3m) in 2022, ceased operations and sold its assets. In a public reflection, Inseco co-founder Simon Hazell cited a mix of internal and external pressures that led to the collapse.

The most severe external blow, according to Hazell, was South Africa’s chronic electricity crisis, known as “loadshedding.”

“The unexpected and sudden onset of late-stage loadshedding had a profoundly negative impact on our business,” Hazell explained. He noted that the recurring four-hour power outages devastated operations by causing temperature fluctuations in the insect colonies, leading to cascading production failures and a fourfold increase in energy costs.

This context highlights the immense operational risks in scaling insect farming, where sensitive biological processes are highly vulnerable to external shocks like energy instability.

A Bet on Cost and Resilience

nextProtein’s leadership and investors are betting that its technology and operational focus can overcome these challenges.

“The challenge is no longer whether insect protein works — it does — but whether it can compete on cost and availability with existing commodities,” said Syrine Chaalala, co-founder and General Manager of nextProtein. “That’s where nextProtein is leading the way.”

The company points to its extensive R&D as a key differentiator. “Our years of operational R&D… have enabled us to continuously refine performance,” said Mtir Ben Aribia, Head of Operations at nextProtein Tunisia. “By testing 100+ feedstock ingredients and optimizing our recipes, we’ve steadily improved our feed conversion ratio.”

This focus on cost-competitiveness was a key draw for its new investors. “By focusing on cost competitiveness and industrial scalability, they are proving that insect-based ingredients can become a mainstream commodity,” said Julie Peyrache, Investment Director on the SWEN Blue Ocean team.

For BII, the deal marks its first direct investment in Tunisia. Sherine Shohdy, BII’s North Africa Regional Director, said nextProtein “paves the way to attract more investments in novel climate startups in support of Africa’s climate innovation.”

With the new capital, nextProtein is positioned to attempt what has proven difficult for others: transitioning insect protein from a niche sustainable product to a reliable, industrial-scale global commodity.