Building a startup is a grueling endeavor, and a successful exit can be immensely gratifying. Just weeks ago, South African custom software firm Operativa realized this payoff when it was acquired by local strategic partner Peach Payments. While Peach Payments CEO and Co-Founder Rahul Jain termed the deal a “natural next step,” the reality for most African startups is far less rosy. While some have found success through mergers or IPOs, these paths are often fraught with challenges. The elusive nature of a profitable exit for many African startups remains a persistent issue.

To shed light on this, we have analyzed over 100 African startup acquisitions with aims to identify patterns and answer critical questions: What is the typical exit path for African startups? And what other exit factors should African founders consider when building their businesses with exit in mind?

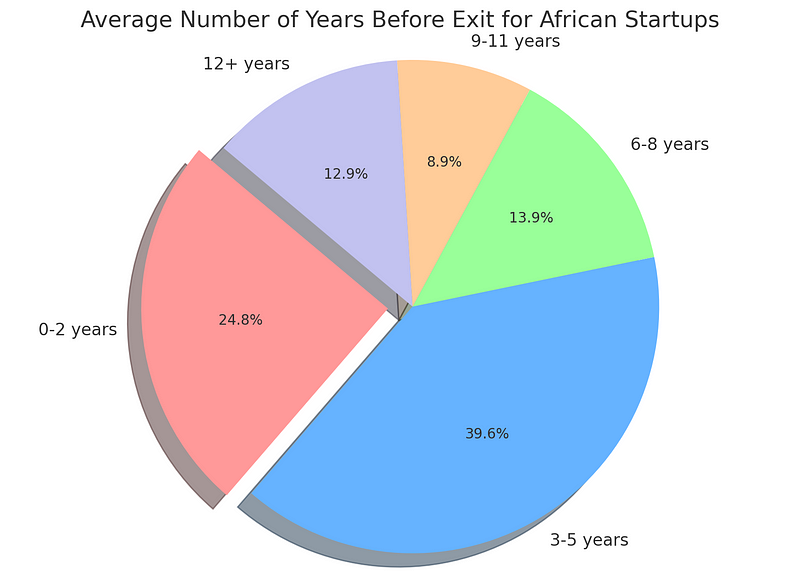

1. Exit Timeline: Plan Early for Success

The timeline to exit is a critical factor for any startup founder. The analysis reveals that most African startups tend to exit within a relatively short to medium timeframe:

- 0–2 years: 24.8%

- 3–5 years: 39.6%

- 6–8 years: 13.9%

- 9–11 years: 8.9%

- 12+ years: 12.9%

Insight: The majority of startups exit within the first 3 to 6 years. Founders should therefore prepare for an exit strategy early, focusing on building scalable models and pursuing rapid growth to capitalize on acquisition opportunities.

2. Primary Sectors: Where Growth and Opportunities Flourish

African startup acquisitions target a spectrum of industries, with notable concentrations in specific sectors:

- Fintech: 20.79%

- Ecommerce: 12.87%

- AI/Tech: 10.89%

- Healthtech: 2.97%

- Mobility/Logistics: 6.93%

Insight: Fintech and Ecommerce are particularly dynamic sectors with significant opportunities for growth and acquisition. Startups in these fields are well-positioned for success, while those in emerging sectors like AI and Healthtech may consider emphasizing on innovation and address niche market needs.

3. Key Hubs: Leveraging Established Ecosystems

Certain countries in Africa emerge as key hubs for startup acquisition activity:

- Egypt: 27.72%

- South Africa: 27.72%

- Nigeria: 24.75%

- Kenya: 11.88%

Insight: Egypt, South Africa, and Nigeria are prominent centers for startup activity. Founders in these countries can benefit from established ecosystems and investor interest.

4. Domestic vs. International Acquisitions: Market Dynamics

Acquisitions of African startups indicate insightful exit patterns, with a balanced split between local and international interests:

- Domestic Acquisitions: 53.47%

- International Acquisitions: 46.53%

Insight: A majority of African startups are acquired domestically, indicating a robust local acquisition market. However, international acquisitions are also significant, reflecting global interest in African startups. Accordingly, African founders should aim for both local relevance and international appeal.

5. Acquisition Values: Navigating Market Transparency

Acquisition values for African startups often remain undisclosed:

- Undisclosed: 71.29%

- Disclosed: 28.71%

Insight: While many acquisition amounts are undisclosed, notable high-value exits have occurred.

6. High-Value Acquisitions

Several startups have achieved significant acquisition values:

- Paystack (Nigeria): Acquired by Stripe for over $200 million.

- Sendwave (Kenya): Acquired by WorldRemit for $500 million.

- InstaDeep (Tunisia): Acquired by BioNTech SE for $684 million.

Insight: High-value exits are attainable, particularly in the fintech and AI sectors.

7. Sector-Specific Strategies: Tailoring Approaches for Success

Different sectors exhibit distinct dynamics and opportunities:

- Fintech: Significant portion of high-value acquisitions.

- Ecommerce: Consistent exits highlight market growth.

- AI/Tech: Increasing interest, particularly for unique tech solutions.

Insight: Tailoring strategies to the specific needs and trends of each sector can enhance startup success. Addressing key pain points and leveraging emerging technologies will position startups for growth and acquisition.

8. Strategic Partnerships: Building for Acquisition

Most exits occur through acquisitions rather than IPOs:

- IPO Exits: 2%

- Acquisition by Larger Companies: 98%

Insight: The majority of African startup exits are through acquisitions. African founders may therefore consider building startups with potential acquisitions in mind, focusing on scalability, innovation, and strategic fit with larger companies. Networking with potential acquirers and understanding their needs can significantly improve exit opportunities.

Comparisons between Domestic v. International Exits

- Financial Value: International acquisitions typically show higher average values compared to domestic exits. This trend reflects the larger capital resources of global investors and their strategic interest in African startups.

- Strategic Preferences: Domestic acquisitions pf African startups usually focus on local market growth and consolidation. International acquisitions, on the other hand, are often motivated by the potential for global expansion, technological acquisition, and strategic market entry.

The Bottom Line

The African startup landscape offers significant potential for founders who can effectively navigate its complexities. By understanding typical exit timelines, focusing on key sectors, leveraging prominent hubs, and building for acquisition, founders can enhance their chances of success. High-value exits are achievable with a combination of innovation, scalability, and strategic partnerships, contributing to a thriving entrepreneurial ecosystem across Africa.

| S/N | NAME OF STARTUP | SECTOR OF STARTUP | PRIMARY COUNTRY OF OPERATIONS | YEAR FOUNDED | YEAR ACQUIRED | NUMBER OF YEARS BEFORE EXIT | NAME OF ACQUIROR/EXIT TYPE | PRIMARY COUNTRY OF ACQUIROR | EXIT VALUE |

|---|---|---|---|---|---|---|---|---|---|

| 1 | Cars45 | Car-listing marketplace | Nigeria | 2016 | 2017;2020; 2021 | 1 | Frontier Car Group; OLX Group; JIJI | Germany; Netherlands; Nigeria (respectively) | Undisclosed |

| 2 | Underlie | Open Banking | Egypt | 2021 | 2022 | 1 | Fintech Galaxy | UAE | Undisclosed |

| 3 | Lamma | e-Grocery and Q-commerce | Tunisia | 2021 | 2022 | 1 | Appetito | Egypt | Undisclosed |

| 4 | Exits | M&A Marketplace | Egypt | 2022 | 2022 | 1 | PIE | Egypt | Undisclosed |

| 5 | Gyft | Mobile Gift Card | South Africa | 2012 | 2014 | 2 | FirstData | United States | Acquired for $54m |

| 6 | FwRun | Ecommerce | Egypt | 2019 | 2021 | 2 | Diggipacks | Saudi Arabia | Undisclosed |

| 7 | Surebet | Betting/Gaming | Kenya | 2019 | 2021 | 2 | TransAtlantic Capital | United States | Undisclosed |

| 8 | Delivroum | Food delivery | Togo | 2018 | 2020 | 2 | Gozem | Togo | Undisclosed |

| 9 | Shago Payments | Ecommerce payments solutions | Nigeria | 2019 | 2021 | 2 | Alerzo | Nigeria | Undisclosed |

| 10 | Sa3ar | Auto tech (car assessment) | Egypt | 2019 | 2021 | 2 | Contactcars.com | Egypt | Undisclosed |

| 11 | Stabus | Mobility | Ghana | 2019 | 2021 | 2 | Treepz (Formerly Plentywaka) | Nigeria | Undisclosed |

| 12 | Disha | One no-code tool for content creator | Nigeria | 2019 | 2021 | 2 | Interswitch | Nigeria | Disha planned to shut down on December 31, 2021, save for the acquisition. Deal amount undisclosed. |

| 13 | DoctorOnline | Healthtech | Egypt | 2020 | 2022 | 2 | CheckMe | Egypt | Undisclosed |

| 14 | Talabeyah | B2B Ecommerce | Egypt | 2020 | 2022 | 2 | MNT-Halan | Egypt | Undisclosed |

| 15 | Gallop Express | Logistics | Egypt | 2020 | 2022 | 2 | GLT Express | Saudi Arabia | Undisclosed |

| 16 | Circle | Proptech | Egypt | 2020 | 2022 | 2 | Milango | Egypt | Undisclosed |

| 17 | Digiduka | Fintech | Kenya | 2019 | 2021 | 3 | MarketForce | Kenya | Undisclosed |

| 18 | Mangwee | Fintech (Mobile payments) | Zambia | 2018 | 2021 | 3 | Zeepay | Ghana | Undisclosed |

| 19 | Harmonica | Dating | Egypt | 2017 | 2020 | 3 | Match Group | United States | Undisclosed |

| 20 | Savi.ng | Fintech (Wealth management) | Nigeria | 2018 | 2021 | 3 | PiggyVest | Nigeria | Undisclosed |

| 21 | Apposit | Enterprise (Software development) | Ethiopia | 2017 | 2020 | 3 | Paga | Nigeria | Undisclosed |

| 22 | Amplify | Fintech | Nigeria | 2016 | 2019 | 3 | OneFi | Nigeria | Undisclosed |

| 23 | QuickHelp | AI (chatbot) | Nigeria | 2015 | 2018 | 3 | 1001 Squared Artificial Intelligence | Canada | Undisclosed |

| 24 | TopCheck | Ecommerce | Nigeria | 2015 | 2018 | 3 | Silvertree | Nigeria | Undisclosed |

| 25 | Fundall | Fintech | Nigeria | 2019 | 2021 | 3 | Emerging Africa Group | Nigeria | Undisclosed |

| 26 | FarmTrust | Blockchain-enabled ecommerce | Tunisia | 2018 | 2021 | 3 | LAMMA | Tunisia | Undisclosed |

| 27 | SwitchPay | Fintech providing alternative payments options to merchants and retailers. | South Africa | 2018 | 2021 | 3 | Adumo | South Africa | Undisclosed |

| 28 | Flo by Saada | Ecommerce | Kenya | 2019 | 2022 | 3 | Elloe | Kenya | Undisclosed |

| 29 | Fatura | B2B Ecommerce | Egypt | 2019 | 2022 | 3 | EFG Hermes Holding | Egypt | Undisclosed |

| 30 | Radar | HR And Payroll | South Africa | 2019 | 2022 | 3 | Firepay | South Africa | Undisclosed |

| 31 | PayJustNow | ‘Buy Now, Pay Later’ | South Africa | 2019 | 2022 | 3 | Weaver Fintech | Mauritius | Undisclosed |

| 32 | Tareeqi | Bus tracking | Egypt | 2018 | 2021 | 3 | eMushrif | Oman | Undisclosed |

| 33 | WooCommerce | Open source ecommerce plugin | South Africa | 2011 | 2015 | 4 | WordPress | United States | Acquisition estimated to be worth over $30 million |

| 34 | WaystoCap | B2B Ecommerce | Morocco | 2017 | 2021 | 4 | MaxAB | Egypt | Undisclosed |

| 35 | Paystack | Fintech (Payments) | Nigeria | 2016 | 2020 | 4 | Stripe | United States | Acquired for over $200m |

| 36 | Bottles App | Logistics (on-demand Delivery) | South Africa | 2016 | 2020 | 4 | Pick n Pay | South Africa | Undisclosed |

| 37 | StarterHub | Community | Egypt | 2015 | 2019 | 4 | RiseUp | Egypt | Undisclosed |

| 38 | Surf Kenya | Wi-fi | Kenya | 2015 | 2019 | 4 | BRCK | Kenya | Undisclosed |

| 39 | Source Beauty | Fashion Ecommerce | Egypt | 2018 | 2022 | 4 | ECC Group | Egypt | Undisclosed |

| 40 | DilenyTech | Artificial Intelligence | Egypt | 2018 | 2022 | 4 | Astute Imaging | USA | Undisclosed |

| 41 | Mowarrid | B2B Marketplace | Egypt | 2018 | 2022 | 4 | Sary | Saudi Arabia | Undisclosed |

| 42 | Crossfin | Card and mobile-enabled payment transactions | South Africa | 2017 | 2021 | 4 | The EMMF I and ARC consortium | South Africa | $94.3m |

| 43 | Nimbula | Enterprise (Cloud computing) | South Africa | 2008 | 2013 | 5 | Oracle | United States | Acquired for $110 million |

| 44 | WayaWaya | AI and Machine Learning | Kenya | 2016 | 2021 | 5 | Ajua | Kenya | Undisclosed |

| 45 | Cape Networks | SaaS | South Africa | 2013 | 2018 | 5 | HP | United States | Undisclosed |

| 46 | Quench | Ecommerce and last-mile delivery service | South Africa | 2016 | 2021 | 5 | The Foschini Group | South Africa | Undisclosed. |

| 47 | SWVL | Mobility | Egypt | 2017 | 2022 | 5 | IPO via SPAC (Nasdaq) | USA | |

| 48 | Sky.Garden | Ecommerce | Kenya | 2017 | 2022 | 5 | Lipa Later Group | Kenya | Buy-out following bankruptcy |

| 49 | Giraffe | Recruitment | South Africa | 2015 | 2021 | 6 | Harambee Youth Employment Accelerator | South Africa | Undisclosed |

| 50 | WizzPass | Visitor Management | South Africa | 2015 | 2021 | 6 | FM:Systems | United States | Undisclosed |

| 51 | Conversio | Digital Marketing | South Africa | 2014 | 2020 | 6 | CM Group | United States | Undisclosed |

| 52 | Sendwave | Fintech (Cross-border payments) | Kenya | 2014 | 2020 | 6 | WorldRemit | United Kingdom | Acquired for $500m |

| 53 | Konga | Ecommerce | Nigeria | 2012 | 2018 | 6 | Zinox | Nigeria | $10m (Reportedly) |

| 54 | ParkUpp | Local Parking Marketplace | South Africa | 2016 | 2022 | 6 | Docklands Ventures | South Africa | Undisclosed |

| 55 | Buni.tv | Entertainment | Kenya | 2009 | 2016 | 7 | Trace Tv | Nigeria | Undisclosed |

| 56 | Baxi | Fintech (Digital agent network) | Nigeria | 2014 | 2021 | 7 | MFS Africa | South Africa | Undisclosed |

| 57 | Devcorp | Enterprise | Morocco | 2014 | 2021 | 7 | ABA Technology Group | Morocco | Undisclosed |

| 58 | Picup | Logistics | South Africa | 2014 | 2021 | 7 | Karooooo | Singapore | Acquired for $4.8m |

| 59 | CallPay | Fintech | South Africa | 2014 | 2021 | 7 | Undisclosed | Undisclosed | Acquired at a valuation of ($6.8m) |

| 60 | DabaDoc | e-Health | Morocco | 2014 | 2021 | 7 | Orange MEA; AXA CIMA | Morocco | Undisclosed |

| 61 | Luno | Blockchain | South Africa | 2013 | 2020 | 7 | Digital Currency Group (DCG) | United States | Undisclosed |

| 62 | OLX Africa | Classifieds | Nigeria | 2012 | 2019 | 7 | JiJi | Nigeria | Undisclosed |

| 63 | Filkhedma | Homes services | Egypt | 2014 | 2021 | 7 | SweepSouth | Egypt | Undisclosed |

| 64 | JUMIA | Ecommerce | Nigeria | 2012 | 2019 | 7 | IPO (Nasdaq) | USA | |

| 65 | Accounteer | Accounting | Nigeria | 2015 | 2022 | 7 | Float | Ghana | Undisclosed |

| 66 | ParceNinja | Ecommerce logistics | South Africa | 2013 | 2021 | 8 | Imperial Logistics | South Africa | Undisclosed |

| 67 | Mobisol | Off-grid energy | Kenya | 2011 | 2019 | 8 | Engie | Kenya | Undisclosed |

| 68 | Tactful AI | Artificial Intelligence | Egypt | 2016 | 2022 | 8 | Dstny | Belgium | Undisclosed |

| 69 | UCOOK | Meal Kit Delivery | South Africa | 2014 | 2022 | 8 | Silvertree Holdings | South Africa | $12.3M |

| 70 | iHub | Innovation Hub | Kenya | 2010 | 2019 | 9 | CcHub | Nigeria | Undisclosed |

| 71 | Nafham | Social startup for free crowdsourced educational content | Egypt | 2012 | 2021 | 9 | Tyro | Egypt | Undisclosed |

| 72 | InstaDeep | Artificial Intelligence | Tunisia | 2014 | 2023 | 9 | BioNTech SE | Germany | $684M |

| 73 | GetSmarter | Edtech | South Africa | 2007 | 2017 | 10 | 2U | United States | Sold for $103-million plus $20-million in cash. |

| 74 | Kapa Biosystems | Life Science | South Africa | 2006 | 2016 | 10 | Roche | Switzerland | Acquired for for $445-million |

| 75 | eLimu | Edtech | Kenya | 2010 | 2020 | 10 | CcHub | Nigeria | Undisclosed |

| 76 | Kngine | AI | Egypt | 2008 | 2018 | 10 | Samsung Electronics | South Korea | Undisclosed |

| 77 | Cheki (Nigeria, Uganda, Kenya) | Auto tech | Nigeria, Uganda, Kenya | 2010 | 2021 | 11 | Autochek | Nigeria | Undisclosed |

| 78 | QuickCash | Fintech | Côte d’ivoire | 2010 | 2021 | 11 | E-Settlement | Nigeria | Undisclosed |

| 79 | MainOne | Data center infrastructure | Nigeria | 2010 | 2021 | 11 | Equinix | United States | $320m |

| 80 | Retail Capital | Fintech (SME Funder) | South Africa | 2011 | 2022 | 11 | TymeBank | South Africa | Undisclosed |

| 81 | Fundamo City | Fintech (Mobile financial services) | South Africa | 1999 | 2011 | 12 | Visa | United States | Acquired for $110 million |

| 82 | Eventtus | Events management | Egypt | 2012 | 2021 | 12 | Bevy | United States | Undisclosed |

| 83 | Exchange4Free | Fintech (Cross-border payments) | South Africa | 2008 | 2021 | 13 | AZA Finance | Kenya | Undisclosed |

| 84 | DPO Group | Ecommerce | Kenya | 2006 | 2020 | 14 | Network International Holdings plc | United Arab Emirates | Undisclosed |

| 85 | Beyonic | Fintech (Payments) | Uganda | 2006 | 2020 | 14 | MFS Africa | South Africa | Undisclosed |

| 86 | Lawtrust | IT security | South Africa | 2006 | 2021 | 15 | Altron | South Africa | Acquired for $17m |

| 87 | Ubusha Technologies | Identity Security Solutions | South Africa | 2003 | 2019 | 16 | Altron | South Africa | Undisclosed |

| 88 | Quirk (Mirum) | Digital agency | South Africa | 1999 | 2016 | 17 | WPP | London, United Kingdom | Acquired for a reported R350 million to R400-million ($35million to $39 million) at the time of the sale. |

| 89 | Genric Insurance | Insurtech | South Africa | 2005 | 2022 | 17 | Old Mutual | South Africa | Undisclosed |

| 90 | Gumtree | Online Classified Ads | South Africa | 2005 | 2022 | 17 | Adevinta | Norway | Undisclosed |

| 91 | Okuhle Media | Digital media | South Africa | 2003 | 2021 | 18 | Trace | France | Undisclosed |

| 92 | orderTalk | Foodtech | South Africa | 1998 | 2018 | 20 | Uber Eats | United States | Undisclosed |

| 93 | SPEED | B2B e-commerce | Egypt | 1997 | 2022 | 25 | X-ERA | UAE | Undisclosed |

| 94 | Scrim App | Social Payment | Nigeria | 2021 | 2023 | 2 | Chimoney | Nigeria | Undisclosed |

| 95 | Local Knowledge | TravelTech | South Africa | 2018 | 2023 | 5 | Neighbourgood | South Africa | $1.5 million |

| 96 | Quicket | Ticketing | South Africa | 2011 | 2024 | 13 | TicketMaster | USA | Undisclosed |

| 97 | Operativa | Enterprise | South Africa | 2023 | 2024 | 1 | Peach Payments | South Africa | Undisclosed |

| 98 | Polymorph | Enterprise | South Africa | 2008 | 2024 | 1 | Octoco | South Africa | Undisclosed |

| 99 | Cmiles CX | Edtech | Egypt | 2021 | 2024 | 3 | QuestionPro | USA | Undisclosed |

| 100 | Kool | Delivery | Tunisia | 2021 | 2024 | 3 | Yassir | Algeria | Undisclosed |

| 101 | Powerhive | Cleantech | Kenya | 2011 | 2024 | 13 | Veteran Capital | USA | Undisclosed |